In the previous chapter, we introduced you to the Bitcoin network and how miners are rewarded for their work with a fixed amount of BTC issued for that occasion by Bitcoin's protocol.

That reward mechanism is a key design of Bitcoin, since it is how new bitcoins have been created since the launch of the blockchain back in 2009. That mechanism is also how Bitcoin gets increasingly scarce over time, as that reward is automatically decreased during pre-programmed events called halvings.

It can't be simpler: when a halving happens, the amount of BTC that each miner gets in reward for successfully adding a block of transactions to the blockchain is divided by two.

Hard-wired in Bitcoin's code, halvings happen every time 210,000 blocks have been successfully mined. Considering that a new block is added to the Bitcoin blockchain approximately every 10 minutes, halvings happen about every 4 years.

BITCOIN HALVING 2028 COUNTDOWN

Past Bitcoin halvings

When the Bitcoin blockchain mined its first block on January 2009, the reward for each block was 50 bitcoins. Today, the reward is currently 3.125 BTC, and after the next halving that should take place on 17 April 2028, the reward will be cut down to 1.5625 BTC.

As you probably know, the maximum amount of bitcoins that can ever exist is 21 million, which is also hard-coded in Bitcoin's protocol. Based on this fact and on the reward halving frequency, it is estimated that the final halving event should take place around the year 2140.

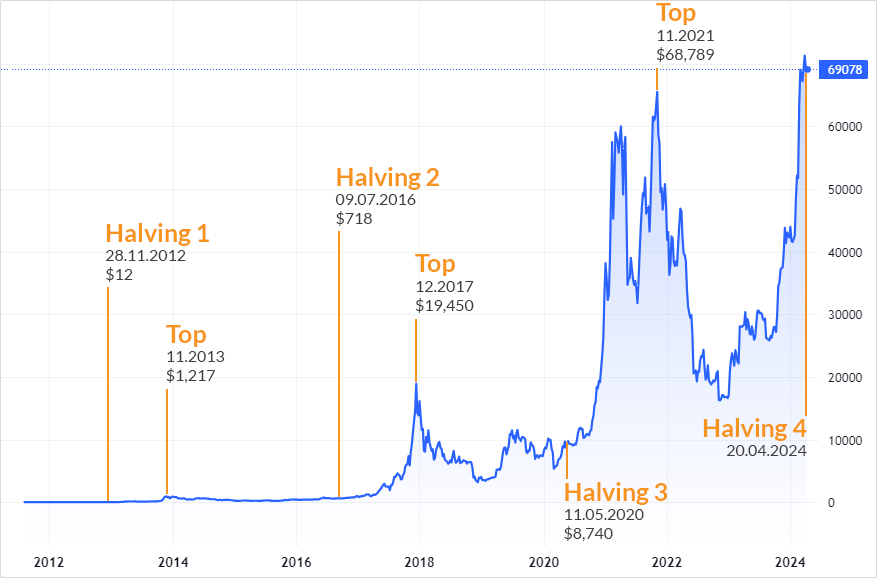

The graph below shows you the Bitcoin halving dates and history:

![Bitcoin halving history Bitcoin halving history]()

Halvings and Bitcoin's price

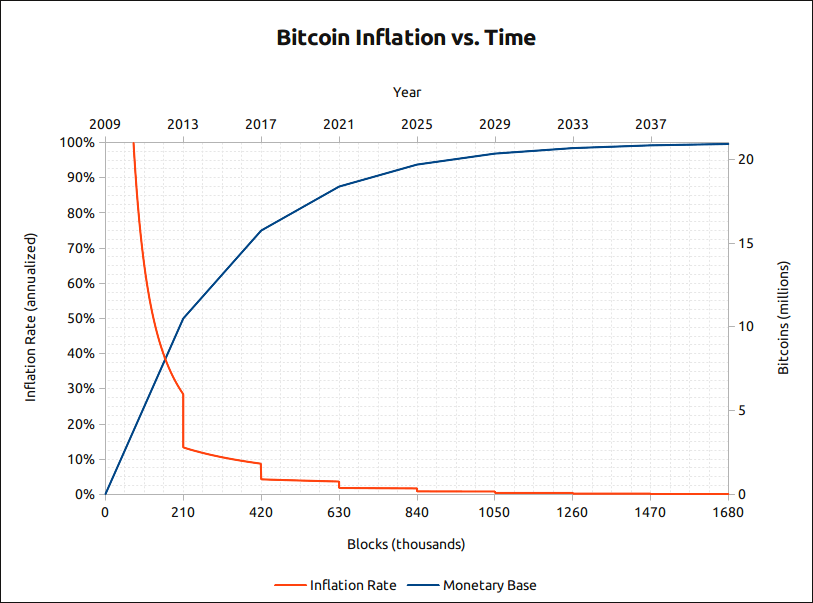

Like any other asset, the market price of Bitcoin depends on the supply and demand. Because they decrease the speed at which new bitcoins are added on the market, halvings have an impact on the supply side of the price equation.

![Bitcoin inflation time chart Bitcoin inflation time chart]()

Credit: bitcoinblockhalf.com

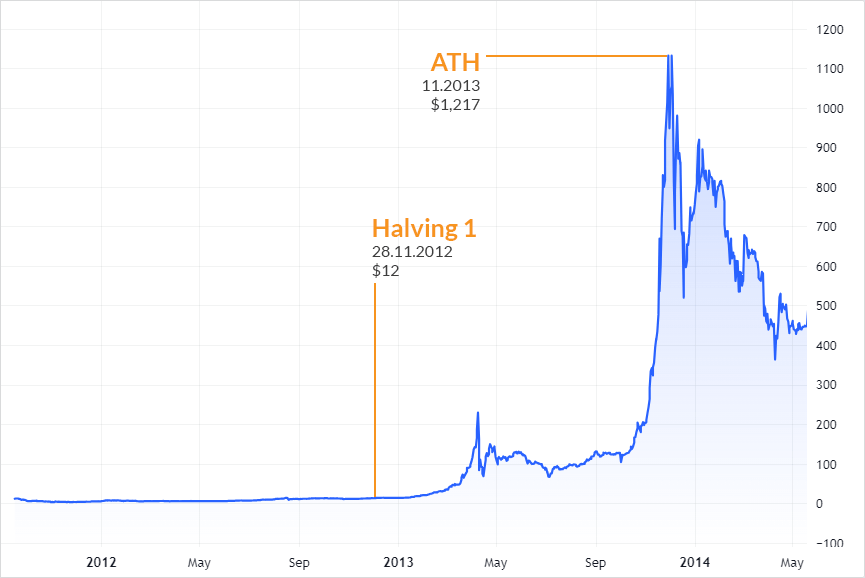

As a result, there has always be much debate and speculation about the relationship between halvings, new Bitcoin all-time highs and bull run market cycles. To fuel it even more, there is not much data to analyze: there have only been three halvings in the past, which all followed a similar pattern on the market:

![Bitcoin's first halving Bitcoin's first halving]()

![Bitcoin's second halving Bitcoin's second halving]()

![Bitcoin's third halving Bitcoin's third halving]()

2024 Bitcoin halving price prediction

The three previous halvings have all preceded by several months the beginning of unprecedented bull run market phases, which all saw new historic price records:

![Bitcoin halvings chart Bitcoin halvings chart]()

Obviously, past performance doesn't guarantee future price movements, but the similarities of previous cycles have set strong expectations for future halving events. Those expectations also come from the nature of a halving itself, which introduces a supply shock to the market. Of course, for a supply shock to increase the price, the demand must grow or at least remain stable. But based on what we have witnessed in early 2024 with the launch of Bitcoin ETFs and their huge success, the demand side of the price equation seems to be safe for now.

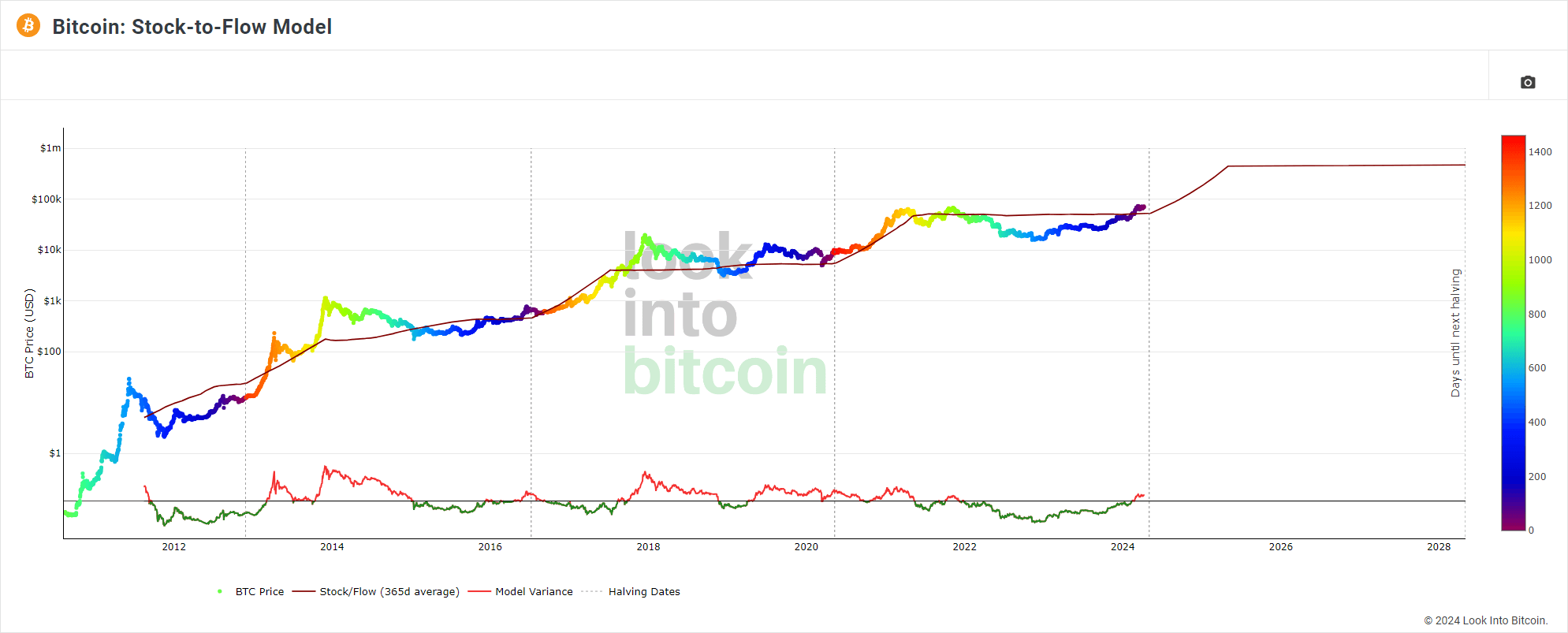

A great forecasting tool that illustrates this relation between halvings and price is the stock-to-flow indicator, which creates a price prediction line (in red) based on the number of bitcoins available on the market relative to the amount of new BTC being mined each year:

![Bitcoin Stock-to-Flow indicator chart Bitcoin Stock-to-Flow indicator chart]()

Credit: lookintobitcoin.com

However, something new and unexpected happened in 2024. Unlike past events, a new bull run began before the halving, and a new all-time high was reached before as well.

Does it mean that the past halving pattern is broken and that a new one is about to emerge? Or is it just a glitch in Bitcoin's clockwork precision?

Only the future will tell!

5 minutes|Yann Gerardi|Published 2024-04-11|Updated 2024-06-06