The mechanisms behind Bitcoin's drop

The Bitcoin price has fallen by more than 40% in just one month, reaching a new yearly low of around $59,930 last week, down over 50% from its all-time high of approximately $126,200 in October 2025 - though it has since recovered to the $70,000 range today.

A key trigger appears to have been heavily leveraged positions held by Asian hedge funds. Several Hong Kong-based funds used structured products tied to U.S. Bitcoin ETFs - including BlackRock's IBIT - and financed these bets with low-cost yen loans. When Bitcoin's rally stalled and financing costs rose, margin calls and forced liquidations followed, accelerating the sell-off.

Former BitMEX CEO Arthur Hayes identifies major US banks as a second source of pressure. According to him, institutions such as Morgan Stanley may have been compelled to sell Bitcoin or related derivatives to hedge risks from structured ETF products. When the price breaches certain thresholds, traders must establish delta hedges, creating negative gamma dynamics in which further declines automatically trigger additional sell orders.

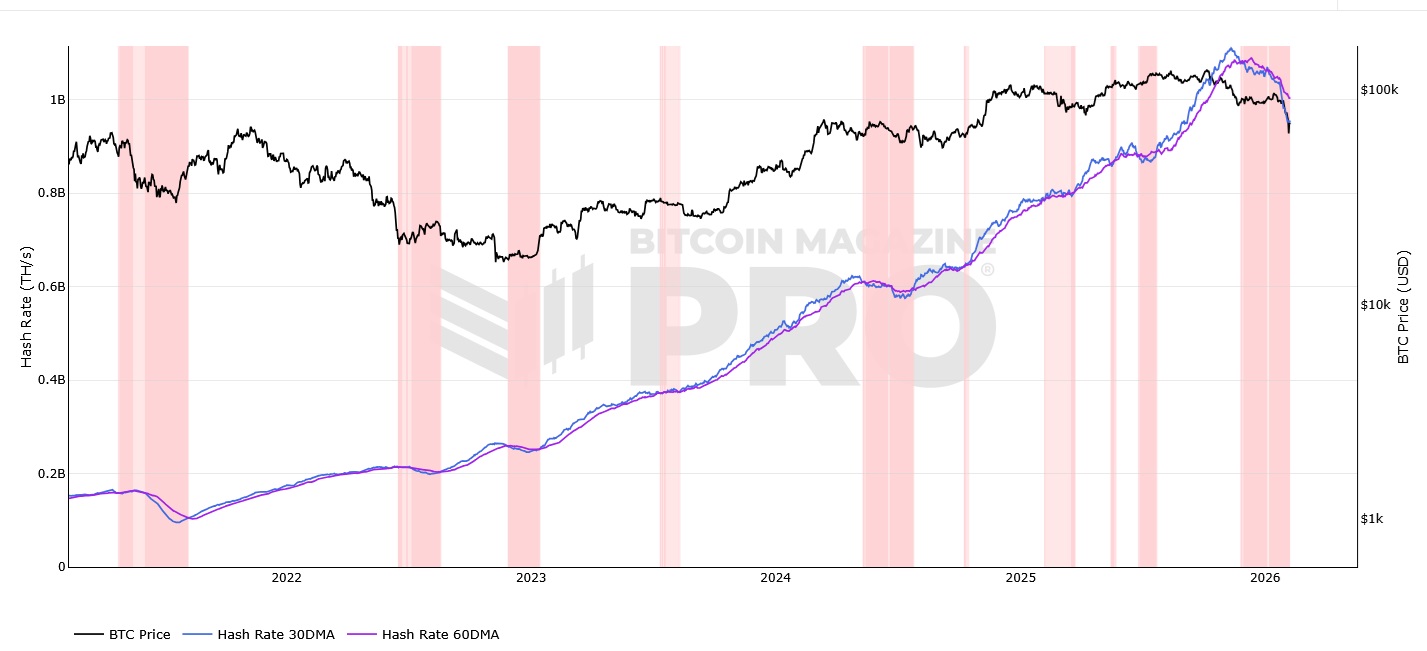

The mining sector is also once again in focus. Market observers note a growing shift of mining capacity toward AI data centers, while the hash ribbon indicator signals mounting economic stress among miners. Average electricity costs to mine one Bitcoin currently stand at around $58,160, with total production costs estimated at approximately $72,700. A sustained drop below $60,000 would further erode profitability for many operations.

Long-term investors are showing caution as well. Wallets holding between 10 and 10,000 BTC now represent the lowest share of total supply in nine months, suggesting this cohort has recently been net sellers rather than accumulators.

Market watchers increasingly argue that the current sell-off is driven more by liquidity and structural factors than by fundamentals. Large long-term “OG” holders and whales have resumed selling below $80,000, while ETF inflows have fallen significantly short of expectations, meaning anticipated demand from traditional finance has yet to materialize.

The downturn was intensified by a cascade of leveraged liquidations that erased billions in positions in a short time. Technically, Bitcoin is now considered extremely oversold, with its gap from the long-term average price at historic levels, and roughly one-third of outstanding holdings are in the red.

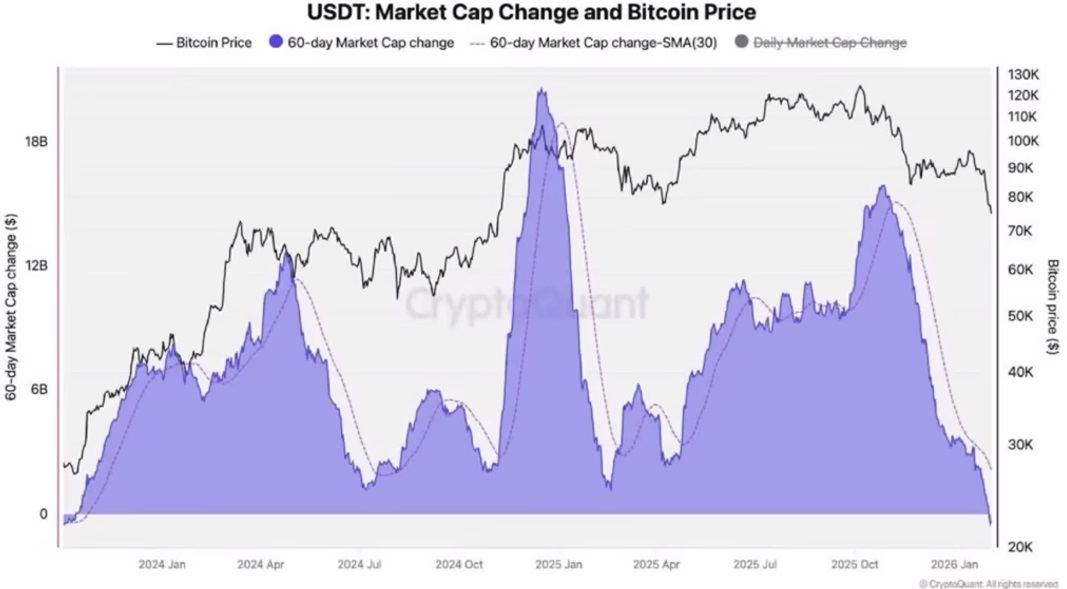

Observers also view the recent decline in USDT circulation as another warning sign, as stablecoins remain a primary liquidity source in crypto markets: a shortage immediately reduces buying pressure.

Overall, the slump feels less like a classic sentiment shift and more like the result of structural constraints: leveraged ETF strategies, bank hedging chains, and intensifying pressure on miners. Stabilization will therefore depend less on Bitcoin narratives and more on whether these technically driven selling dynamics exhaust themselves - and whether fresh demand can emerge amid rising financing costs.

🌎 Political power play in the US, clampdown in China

The global crypto industry is intensifying its political influence in the United States, even as China has imposed a complete ban on the issuance of stablecoins and tokenized real-world assets, and Washington explicitly ruled out any active support for the Bitcoin market.

In the U.S., crypto-aligned political action committees (PACs) and super PACs have dramatically increased their financial firepower ahead of the 2026 midterm elections. Fairshake, the leading super PAC backed by the crypto industry, raised approximately $133 million in 2025 and now holds more than $190 million (with recent reports citing $193 million) in cash on hand. Major donors include venture capital firm Andreessen Horowitz (a16z), Coinbase, and Ripple. Overall, hundreds of millions of dollars from the crypto sector have poured into election campaigns and advocacy efforts in recent years.

The primary objective is to secure passage of a comprehensive digital asset market structure law, which remains stalled in the Senate. Coinbase recently withdrew support for the current draft, largely due to provisions that could restrict interest-bearing or reward-bearing stablecoin products for consumers, a measure pushed by traditional banks and decried by the industry as stifling innovation.

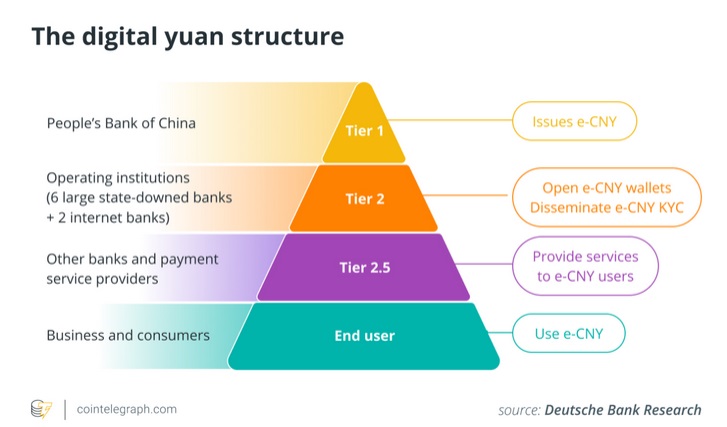

Meanwhile, China is further tightening its regulatory grip. The People's Bank of China and multiple supervisory authorities have prohibited both domestic and foreign entities from issuing renminbi (RMB)-backed stablecoins or tokenized real-world assets, with the ban applying to both onshore and offshore RMB. This follows a series of policy shifts and reinforces Beijing's strategy of excluding privately issued digital currencies from the formal financial system while bolstering the state-controlled digital yuan (e-CNY). Most recently, China permitted commercial banks to offer interest on deposits held in the digital yuan to boost its adoption.

Washington has sent clear signals as well. U.S. Treasury Secretary Scott Bessent stated unequivocally in a recent hearing that the government lacks the authority - and has no intention - of stabilizing the Bitcoin market through direct purchases or regulatory interventions. While the U.S. will continue holding seized Bitcoin from law enforcement actions, any additional acquisitions would be limited to budget-neutral measures, such as converting existing reserves. Open-market purchases to stimulate demand are explicitly ruled out.

The US House of Representatives has also passed a comprehensive transitional budget to prevent another government shutdown. The political tug-of-war around the shutdown had already delayed important legislative projects, including the planned market structure regulation for digital assets, thereby compounding the regulatory uncertainty for the industry.

The political approach to crypto continues to diverge internationally. In the US, the industry is aggressively shaping regulatory frameworks through substantial campaign financing. In China, policy firmly prioritizes state control by excluding private digital money forms. Washington's rejection of any market-support role further emphasizes that political influence may help define the rules, but it offers no implicit guarantee of investor protection or price stability.

🥵 The first institutional stress test

The recent slump in Bitcoin and Ether prices is extending beyond mere price declines, visibly impacting corporate balance sheets, ETF portfolios, and the broader industry's operational infrastructure.

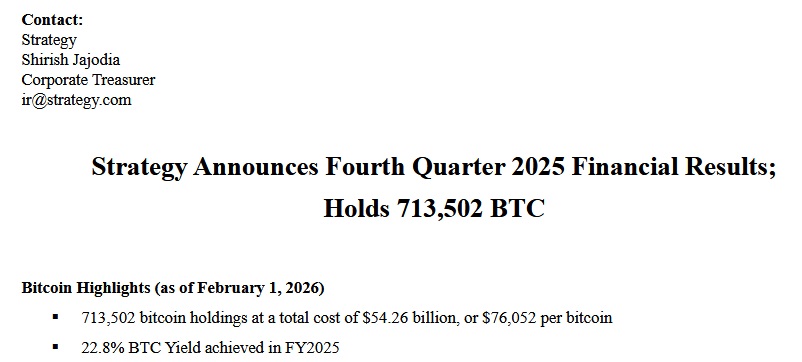

This effect is especially pronounced among companies with heavy crypto treasury allocations. Strategy reported a net loss of $12.4 billion for the fourth quarter of 2025, largely driven by a roughly 22% drop in Bitcoin's price during the period. The asset fell from highs around $126,000 in October to below $88,500 by year-end and has traded significantly lower in early 2026.

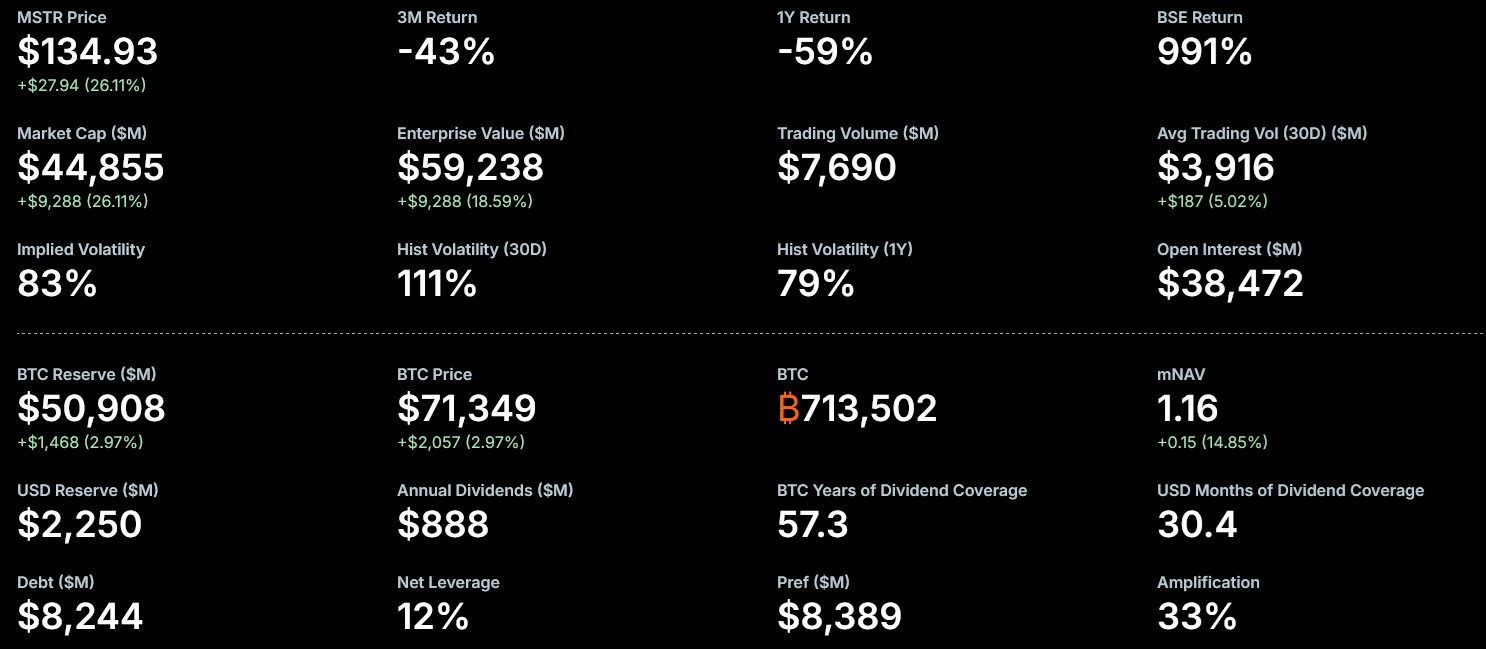

Strategy holds 713,502 BTC at an average acquisition cost of $76,052 per coin, and is currently down around 17.5%. Despite the price decline, management highlights a strong capital position, including $2.25 billion in liquidity and no major debt maturities until 2027.

The spot Bitcoin ETF market is delivering an early real-world stress test for institutional investors. BlackRock's iShares Bitcoin Trust (IBIT), the largest of such product, has seen aggregate (dollar-weighted) investor returns turn negative amid the sell-off, as heavier inflows occurred at elevated prices.

This marks the first time many large investors - entering via regulated vehicles - have faced Bitcoin's full downside volatility. U.S. spot Bitcoin ETFs recorded recent daily inflows of around $562 million, yet remain in negative territory year-to-date after earlier multi-billion-dollar outflows. Ether ETFs have not benefited from any short-term rebound.

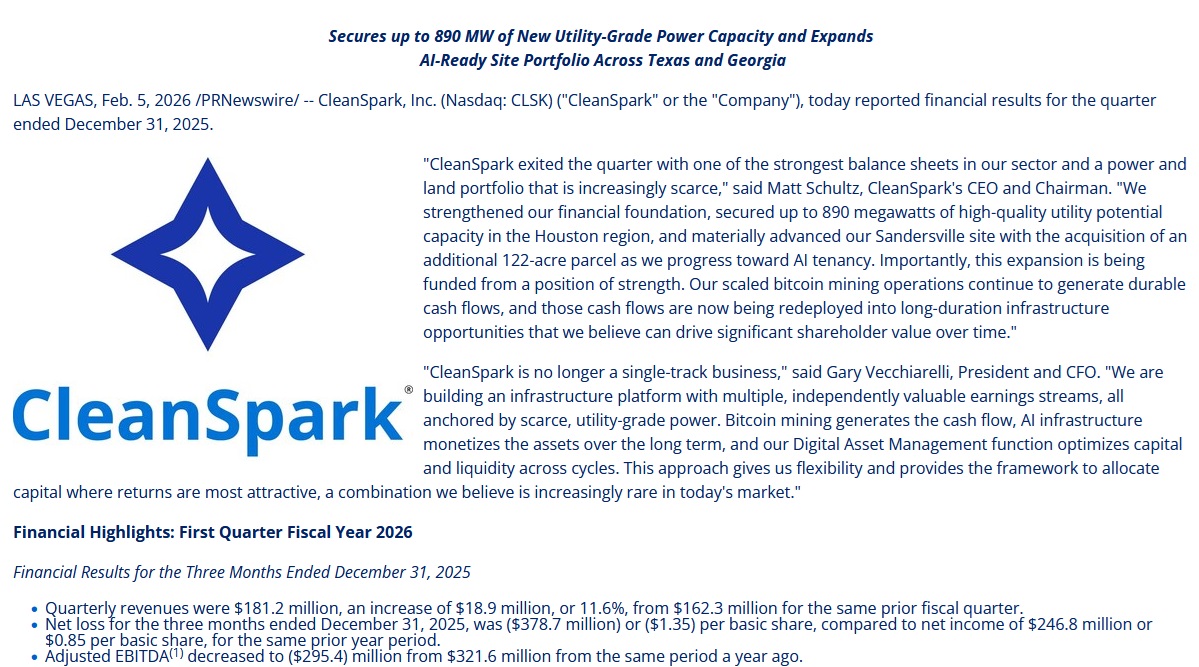

Operationally, miners face compounded pressure from falling prices and elevated costs. Shares of CleanSpark and IREN dropped sharply in double digits following disappointing quarterly results. CleanSpark slightly missed revenue expectations while posting a net loss of $378.7 million for the quarter ended December 31, 2025. IREN reported a net loss of $155.4 million in its fiscal second quarter (same period), with revenue declining sequentially.

Both firms are increasingly pivoting toward AI infrastructure to diversify revenue by repurposing data centers beyond pure mining.

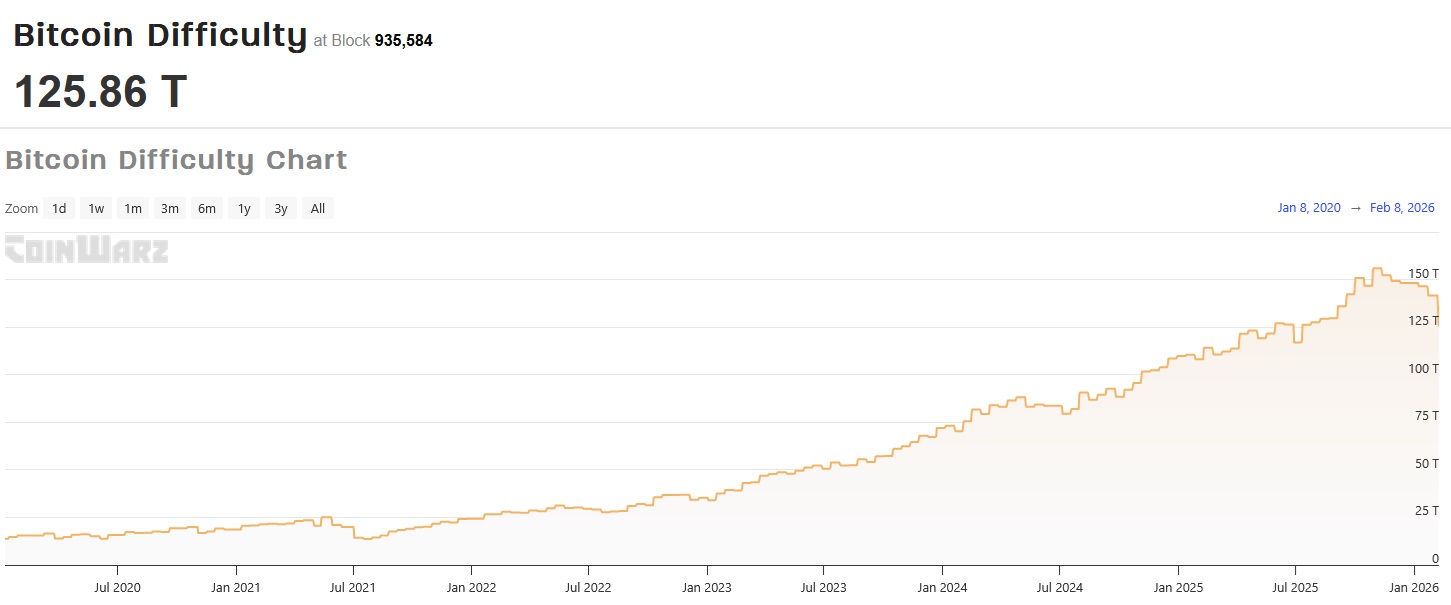

Network-level metrics underscore the strain: Bitcoin mining difficulty recently plunged 11.16%, the steepest single drop since China's 2021 mining ban, while total hashrate hit a four-month low. The adjustment was amplified by severe US winter storms, which forced widespread curtailments and temporarily slashed power at major pools like Foundry USA by around 60%.

The current downturn illustrates the deep interconnections among market prices, financing structures, and infrastructure. Treasury strategies, ETF flows, and mining operations no longer operate in silos; they amplify one another during exogenous shocks like weather events or sharp price moves. While diversification into AI may provide income stability for miners, the core business model remains tightly tied to digital asset volatility.

🤔 Ethereum L2s no longer meaningful?

Last week, Ethereum co-founder Vitalik Buterin declared that the original vision of Layer 2 (L2) networks as the primary scaling mechanism for Ethereum is “no longer meaningful”:

He argued that many L2 systems have yet to fully inherit Ethereum's security guarantees, with critical components - such as bridges - still reliant on multisignature setups rather than decentralized mechanisms. In his view, expanding transaction capacity through such partially trusted constructs does not equate to genuine scaling of Ethereum itself.

Buterin advocated shifting greater focus to protocol-level improvements on the mainnet (L1), particularly the development of native rollups, which are directly integrated into Ethereum's consensus layer for seamless verification. He described moderate gas limit increases as a useful supplementary optimization, with developer discussions already exploring hikes to boost per-block transaction throughput. Long-term, Ethereum's roadmap aims for massive mainnet capacity gains.

Major L2 developers responded constructively but defended their continued centrality. Representatives from Optimism, Arbitrum, Base, and Starknet welcomed a stronger role for the Ethereum mainnet in principle. Optimism highlighted persistent technical challenges, including long staking withdrawal times, the absence of production-ready proof systems for full decentralization, and limited tools for cross-chain applications.

Arbitrum cautioned against sidelining rollups too aggressively, noting that during peak activity, individual L2s often process far more transactions per second than the mainnet. Base stressed that L2s must increasingly differentiate through specialized features like application focus, superior user experience, privacy enhancements, and advanced account abstraction.

Buterin reiterated his optimism about native rollups, especially once zero-knowledge EVM (zkEVM) proofs are natively supported on the base layer, enabling trust-minimized verification and better interoperability.

The debate gained extra visibility amid Buterin's recent ETH transactions. He sold approximately 2,961 ETH worth around $6.6 million following earlier announcements of planned withdrawals, with total sales over a few days reaching higher figures in some reports amid falling prices.

Separately, he reserved 16,384 ETH (roughly $45 million) for long-term commitments to privacy technologies, open hardware, and verifiable software infrastructure.

Meanwhile, on the Bitcoin side, Tether is deepening its infrastructure footprint by releasing MiningOS, an open-source operating system for Bitcoin miners. Designed for both small-scale operators and large industrial sites, the modular, self-hosted platform uses peer-to-peer communication to manage, monitor, and automate operations, aiming to lower barriers for new entrants and reduce dependence on proprietary vendor software.

These parallel developments - Ethereum's push to consolidate scaling and security at the protocol level, contrasted with Tether's open-source tooling for Bitcoin mining - highlight how competition in crypto is increasingly waged at the infrastructure layer. Ethereum seeks tighter integration and control in its core design, while initiatives like MiningOS promote openness to foster broader participation in Bitcoin's ecosystem. True decentralization will ultimately hinge not on announcements, but on widespread adoption and proven operational maturity of these innovations.

🌊 The crypto industry faces a wave of consolidation

The current market downturn is accelerating structural shifts across the crypto industry. Companies are pursuing economies of scale through mergers and acquisitions, stablecoins are gaining further importance despite broader headwinds, and major platforms are actively defending trust amid emerging crisis narratives.

Tom Farley, CEO of institutional trading platform Bullish, anticipates “massive consolidation” in the sector over the coming months. Drawing parallels to the traditional stock exchange industry - long marked by takeovers and mergers - he views the recent price decline as the key catalyst. Excessive valuations and unrealistic expectations are no longer tenable, he argues.

Many projects possess individual products but lack scalable business models. While a shake-out could forge stronger entities, it will likely involve eliminating redundancies, restructuring, and job losses.

While business models are coming under pressure, stablecoins are bucking the trend.

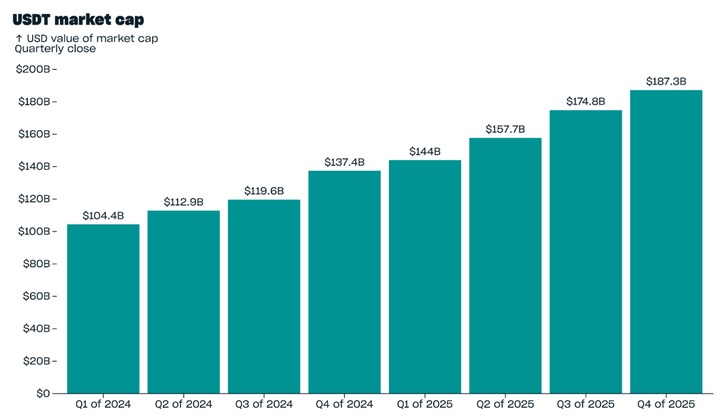

Stablecoins, however, are bucking the trend and showing resilience. Tether reported record figures for Q4 2025: USDT reached a market capitalization of $187.3 billion, up $12.4 billion in the quarter despite the broad market downturn triggered by October's liquidation cascade. On-chain usage surged, with the average number of active USDT wallets climbing to 24.8 million—representing nearly 70% of all stablecoin-holding wallets. Quarterly transfer volume hit $4.4 trillion across 2.2 billion transfers.

Tether's reserves stood at $192.9 billion, yielding net equity of $6.3 billion. Notably, its U.S. Treasury exposure reached $141.6 billion (placing it among the top global holders if ranked as a sovereign entity), while reserves also include significant Bitcoin (96,184 BTC) and gold holdings. Amid ongoing relevance in illicit transfers, Tether continues expanding cooperation agreements for monitoring and freezing funds.

Trust issues remain central for centralized trading venues. Social media has circulated warnings of an “FTX 2.0” scenario for Binance, including coordinated posts from alleged users announcing mass account closures. On-chain analysts, however, report no acute stress: CryptoQuant data shows Binance holding approximately 659,000 BTC—virtually unchanged from end-2025 levels—with no material reserve erosion during the sell-off.

Binance has highlighted the risks of organized disinformation while acknowledging legitimate community criticism, particularly around the causes of October 2025's liquidation event (over $19 billion wiped out), which remains under public debate.

Institutional investors are repositioning accordingly. ARK Invest sold roughly $17.4 million worth of Coinbase (COIN) shares and purchased nearly the same amount ($17.8 million) in Bullish shares in early February 2026 trades, signaling a rotation amid the rout—even as Coinbase remains a larger holding in ARK's portfolios.

The downturn is functioning as a selection mechanism: Takeovers and strategic pivots grow more probable as capital costs rise and prior valuation illusions fade. Yet Tether's record performance demonstrates that crypto usage—particularly liquidity and payment infrastructure—can expand independently of risk-asset prices. The critical bottleneck is trust: Platforms unable to deliver credible transparency during stress risk becoming acquisition targets rather than acquirers in the impending consolidation wave.