Today, we take money for granted. Not only do we take it for granted but many of us believe money to be a static something, whose nature is carved in stone. Nothing could be further from the truth. Money's essence has been continuously changing ever since its inception. It boasts a long history; indeed the history of money is ultimately the history of mankind as well.

How it all started

This history begins with prehistoric tribes. Just like we human beings today, members of tribal clans were humans made up of flesh and blood. As such, they too had different talents, desires, and preferences. Consequently, these premodern beings were carving, collecting, hoarding, and exchanging different things. To some, beads appeared desirable. Others coveted shells, while yet others were cherishing furs or tusks.

![Native shell money from the Pacific Native shell money from the Pacific]()

Seashell bead money

Credit: Queensland Museum

Since the dawn of man, we have collected, hoarded, and sometimes exchanged different collectibles. As a matter of fact, what we consider real exchange - or actual trade, didn't really occur within tribal clans. Social hierarchy was pretty much set, and each and everyone knew their place within the hierarchy, what to do, and what to own.

It is when people starting moving around, when human interaction started transcending the borders of clans that things started to change. When strangers began mingling and interacting with other strangers, exchange and trade slowly developed.

Soon enough, commodity money emerged from what used to be collectibles and hoardables, in order to facilitate that trade. Among these commodities, gold and silver took the dominant position and gradually established themselves as commodity money par excellence.

![One of the oldest coins, a Greek Electrum from 650 BC One of the oldest coins, a Greek Electrum from 650 BC]()

One of the oldest coins, a Greek Electrum from 650 BC

Credit: cngcoins.com

Precious metals and paper money

These precious metals were soon circulating in the form of minted coins, it's more convenient to carry around in your pocket after all. With them, proper measurement of mass and weight was made easier. In turn, this allowed goods and services to be assessed and expressed in definite exchange ratios: 1 coins buys 2 apples, etc. This convenience allowed exchange and trade to bloom.

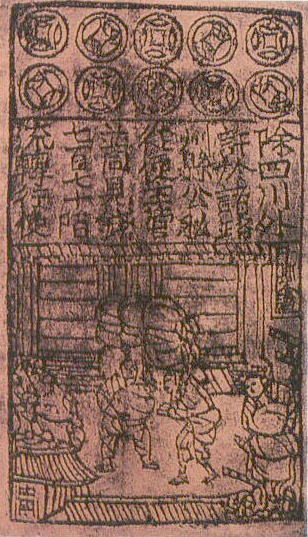

![Paper money from the Song Dynasty, 11th century Paper money from the Song Dynasty, 11th century]()

Paper money from the Song Dynasty, 11th century

Source: Wikimedia

Throughout the centuries, ever more sophisticated methods of using coins were developed. In the 15th century however, the invention of the printing press would radically change things. What was already used by merchants and bankers in the Italian city-states of Venice, Florence and Genoa could suddenly scale easily: paper money was born. Increasingly, it was no longer gold coins or silver ingots that changed hands but sheets of paper that were denominated in ounces or bars precious metals.

Different forms of paper money like bills of exchange or banknotes were invented, and variety as well as complexity increased. All these different instruments had one thing in common though: they were all redeemable for gold or silver that existed in an actual vault somewhere.

To be backed or not to be backed

With this new layer of abstraction, a new temptation emerged for the person issuing the paper. What if the paper didn't have to be redeemable? Does it really have to correspond to something tangible? While doing this would hamper trust in the issuer and its issued paper, the temptation ultimately was too great and could not be resisted.

![100 dollars gold certificate 100 dollars gold certificate]()

A 100 dollars gold certificate

Credit: National Numismatic Collection, National Museum of American History

During the last few centuries, more often than not a paper money's promise to be redeemable into gold was broken. This allowed the respective issuer to issue a bigger amount of paper promises than there was gold or silver in the actual vault to back them. The infamous money printing machine was born.

As a matter of fact, the greatest stunt in this respect was pulled by governments when many of them entered the two World Wars, whose gigantic expenses could only be paid for by suspending redeemability of their paper currencies.

While governments aimed to restore a gold-pegging for their paper money after the wars, in retrospect this turned out to be mere lip service. In 1971, the United States of America cut its ties to gold, and with it the entire planet followed suit.

Having left the gold standard once and for all, the world became the realm of fiat money, i.e. government-issued money that isn't backed by something tangible.

As such, the paper currencies that you use every day are not backed by gold anymore, but by government bonds and the promise of their respective central bank to keep them functional.

Not only is the money of today not backed by gold any longer, but there is hardly any paper involved either. Paper money that we usually associate with cash is on the retreat. Today, the name of the game is electronic money. It too comes in a variety of different forms, be it bank deposits, debit/credit cards, or e-cash transferred through mobile banking applications.

While the form of these new instruments is entirely different from paper money, their essence and substance are essentially the same. Electronic forms of money are still descendants of paper money, which is itself a descendant of gold. On a fundamental level, nothing has really changed.

What is money anyway?

Now that we got a glimpse of the history of money and learned that money has undergone a real transformation over the centuries, let's talk about what money really is.

With all the different forms of money that have existed and still exist, is there even something like the one and only money?

Many would tend to believe that national currencies like the US dollar, Euro, or Swiss francs are what should be called real money. While these government currencies are surely dominant today, there is no guarantee that they will continue to do so in the future. Telling by the paper money's poor legacy, their prospects seem indeed rather bleak.

What serves as money is always time-specific and context-dependent. There is no such thing as the money for everyone and everything.

Trying to answer what money is, the great Austrian economist Friedrich August von Hayek coined the term "moneyness". As he rightly put it:

“Money is not to be understood as a noun but as an adjective.”

![Not to be confused with Salma Hayek Friedrich Hayek]()

Friedrich Hayek

According to Hayek, things in the real world exhibit more or less moneyness, meaning that some things are more money-like than other things in certain contexts.

Continuing on Hayek's thought, we can say that what is money is rather subjective. In today's complex world, there is a hierarchy of money. For some people, some things might function as money while for some others, the very same thing may have no moneyness at all.

For example, the money reserves that central banks give out to commercial banks act as money for the latter, but they have no direct monetary use for ordinary people. At the same time, bank deposits can be perfectly used by bank clients to pay any sort of debts, but they are of no use in the context of a financial relationship between a central and a commercial bank.

Money ultimately is a mean to an end. It can take many different forms, depending on the respective end. As such, money can be seen as an institution to scale human interaction. It is a language to communicate with other peers in the here and now but also in the future.

Money for the present embodies the so-called medium of exchange or means of payment. Money for the future has the function of being a store of value. In this regard, money serves as a vehicle to save time and energy that can be released later on in time.

Evaluating the quality of a money

The hardness of money

How does money come into being? Today's fiat money is created by different institutions. Following the aforementioned hierarchy of money, fiat's base money is created by central banks, while on top of this base money, money surrogates and derivatives are issued by commercial banks and other bank-like entities.

Our ancestors were bringing money into existence through force and energy: minting money out of resources crafted or mined from the real world. Native Americans' Wampum or Micronesian's rai stones were examples of hard, crafted money.

Gold and silver are the typical example of mined and minted money. These kinds of money are usually referred to as commodity money, since they were made out of a commodity.

The costlier it is to produce a commodity money, the harder we say that money is. Precious metals are considered to be among the hardest of all monies, since they exhibit rising marginal costs in production. This means that production costs rise with every additional unit of gold that is being produced, making it ever more costly to produce an additional unit of gold. This is the defining characteristic that makes gold a hard money.

Centralization vs decentralization

Apart from hardness, another important feature defining the nature of money revolves around its degree of centralization or decentralization. While there is no money that is either entirely centralized or completely decentralized, different monies can be categorized according to a spectrum of “more” or “less”.

If the issuance of a money is done by an institution or a committee, the degree of centralization is pretty high. This is the case for today's fiat money system. The issuance of fiat base money is carried out by a respective central bank, which is a committee made of a few people. This board of technocrats conducts monetary policy in response to how they interpret the current economic situation in their country.

As said, no monetary system (nor money) is completely centralized. Looking at today's fiat system, while the base money is centrally issued and governed, the expansion (and contraction) of money surrogates and money-like instruments is happening in a decentralized fashion: each individual bank contributes to it. Nonetheless, the issuance of these respective money surrogates is still done centrally by different intermediaries.

How does today's paper money rank?

If we judge by looking at the factors of hardness and decentralization, fiat money does rather poorly. Fiat currencies are neither hard nor are they decentralized. Because of today's ultra-expansionary monetary policies all around the globe, fiat money is subject to constant devaluation. Although US dollars, Euros or Swiss francs seem to be price-stable vis-a-vis everyday goods like bananas, milk or a kilo of rice and consumer price inflation is according to official statements close to zero, these fiat currencies are consistently losing value over the years.

Fiat money's race to the bottom becomes particularly obvious when asset price inflation is factored in: a given amount of fiat money buys you less and less of a given harder asset, like real estate, gold or even stocks, over time.

What about gold?

While gold is the hardest of all these traditional assets and has always been perceived as the best store of value, the precious yellow metal is not really decentralized either. It is true that gold's mining process is not centrally orchestrated and is conducted by many dispersed actors, but because of its heavy weight and high transaction costs, gold has experienced a natural course of ever-increasing centralization.

![Hard as a rock Gold bar]()

How hard am I?

Used as a means of settlement only, gold started to get concentrated in vaults, leading to ever greater centralization. While gold is still spread out in the hands of people in the form of coins, bars, and jewellery, a great amount of gold today resides in the vaults of central banks.

Introducing censorship resistance

Compared to gold, fiat money is more centralized. While this dichotomy of decentralization and centralization is used quite often, the term “censorship resistance” is a better way to describe what people usually mean when they refer to the former.

What do we mean by censorship resistance? Today, we finance stuff by using fiat money as the main medium of exchange in a world made of intermediaries, who intermediate between different parties willing to carry out transactions.

Intermediaries authorize or decline transactions, according to the financial regulations they are subject to. As a result, the level of decentralization or censorship resistance of today's fiat system is weak. Transactions can be blocked based on predetermined factors.

A very shocking but telling illustration happened in late 2010 as several financial companies were ordered by the US government to suspend donations for Wikileaks, a non-profit organization, information and news leak service. Not only did US companies like Visa, Mastercard, or Paypal block payments to the Wikileaks' website, but even the Swiss post office's financial arm PostFinance froze Wikileaks' founder Julian Assange's bank accounts.

While Wikileaks' actions are up for debate, this example shows that today's fiat money system can censor and block anyone at will. Be it for political, religious, or other reasons, the fact that this is possible should be a warning sign to anyone in favour of a free society.

Asking the right question

In conclusion of all the above, money is indeed a delicate issue. Money is an abstract mean to an end, but it can quickly turn into an end itself by a force called greed, which is inherently driving human beings. Because of this, money usually gets a bad name. For many people, money is a malevolent force that corrupts society. It is not for nothing that the saying goes: “Money rules the world”.

But who rules over money? As trivial as this question sounds, the answer is crucial. Should you only build your definite judgement on money if you understand what or who controls it? If you struggle to answer this question, you might want to go back to the previous paragraphs and reread them.

Enter Bitcoin

What does all the above has to do with cryptocurrencies? Let's summarize briefly the state of our everyday money:

- It lost its hardness, it's just paper and lines in Excel sheets

- It is highly centralized, very few people control it

- It can be easily censored and taken away from you

See the problem? These issues have increasingly worried people and economists alike in the last decades, and the 2007-2008 financial crisis was a point of no-return for many.

It was about that time that the question of who rules over money was also asked by an online pseudonym called Satoshi Nakamoto. In an obscure email list going out to cryptographers, libertarians, and crypto-anarchists, Nakamoto proposed a solution and introduced the concept of a peer-to-peer electronic cash system. The unique selling point? A network of peers that would run and function all by itself, without any central authority overseeing it.

In his early email conversation with people, he mentioned why a central authority supervising money has historically always been a bad choice:

“The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible.”

Because traditional money and finance depend on a great level of trust towards them and because that trust has repeatedly been broken, Nakamoto proposed an alternative system called Bitcoin. This system should be a new system where fewer intermediaries are needed, where trust can be dispersed among a greater number of incentivized actors, and where things are mostly governed and executed by programming code.

Bitcoin is designed to be a system of rules without rulers. It is anarchic, but not chaotic. It is a financial system that belongs to everyone and no one at the same time. Its purpose is to be a money of the people, by the people for the people.

Of course, in reality Bitcoin is not perfect (nothing is) and it is not completely trustless either. But that is a topic for another article.

That's it! You now know the history, nature and quality of money, and what are its shortcomings that Bitcoin and cryptocurrencies are trying to solve. Congrats!

15 minutes|Pascal Hügli|Published 2021-02-10|Updated 2024-06-13