Today, Bitcoin is commonly understood to be a cryptocurrency. While this is certainly correct in the narrow sense of the word, it misses a much bigger picture.

As you will see in this article, Bitcoin is a new form of money in the true sense of the word, powered by its underlying peer-to-peer transaction network.

In its entirety, Bitcoin is a full-stack monetary system with no outside dependencies, with the ability to run and carry out transfers of value on its own.

Because of Bitcoin's epic proportions, it seems to make more sense to consider Bitcoin as a discovery rather than an invention. Following a process of trial and error, many predecessors like Hashcash, DigiCash, b-money or Bit Gold had already tried to achieve the same thing, only to fail in one way or another.

But in the end it was a pseudonymous programmer (or group of programmers) called Satoshi Nakamoto who succeeded and introduced Bitcoin to the world. What looks like a one-time invention is in fact the culmination of various breakthroughs in information technology, cryptography, and computer engineering.

A perfect timing

It's no exaggeration to call Bitcoin's appearance an immaculate conception shrouded in a creation myth. And the mysterious story of Bitcoin reads like a thriller:

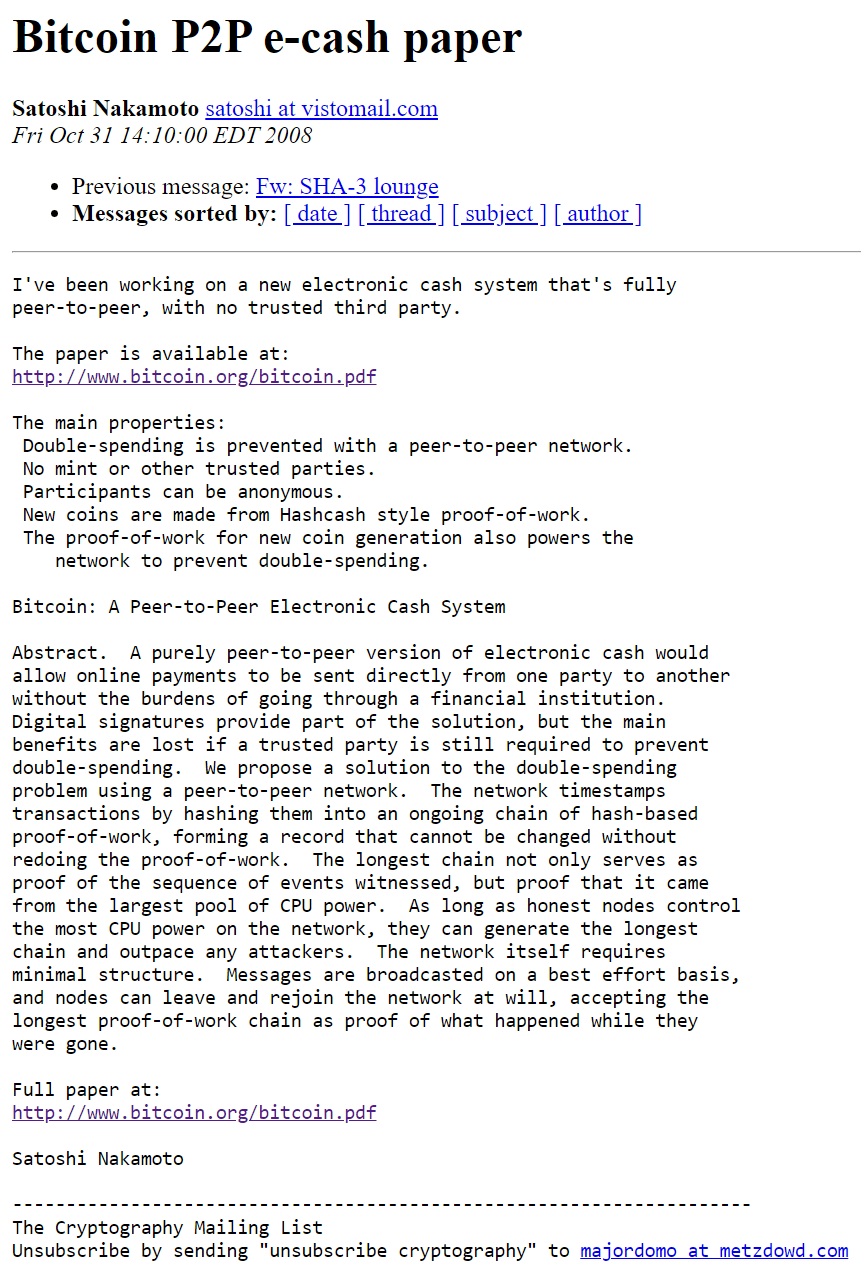

It was October 31st, 2008. A little more than a month after the financial crisis peaked, a message from a pseudonym called Satoshi Nakamoto reached the subscribers of an obscure e-mail list consisting of cryptography experts.

“I've been working on a new electronic cash system that's fully peer-to-peer, with no trusted third party.”, he wrote and before going on and explain Bitcoin's main properties.

In that email, Satoshi included a link to a white paper uploaded to bitcoin.org, a new website registered two months earlier. The nine-page paper describes a new payment system called Bitcoin.

![Satoshi Nakamoto's Bitcoin email]()

To the cryptography geeks and computer scientists who received that email, the idea of digital crypto money was by no means new.

There had already been many such attempts in the 90s, but all had failed. Unsurprisingly, the Bitcoin paper was met with little enthusiasm at first. Why should this proposal be fundamentally better than the previous ones?

What really made a difference was the fact that it not only combined several technological breakthroughs, but was very much rooted in the spirit of Austrian economics.

When it comes to spontaneous, non-government money, no other school of thought has so carefully and diligently thought about this topic, leading to interesting insights about money.

Because Satoshi Nakamoto had clearly drawn upon those insights when conceptualizing Bitcoin, the cryptocurrency came out to be a truly interdisciplinary endeavor rooted in realistic thinking about how money works.

And another important thing was special about Bitcoin: Nakamoto was anonymous. The fact that no one knew (and still don't) who was behind the pseudonym made the whole thing mysterious and appealing.

This gave Bitcoin its own quasi-religious creation myth. Bitcoin's founder staying anonymous helped the project gain enough traction without being stopped by a government or anyone else. Because there was no identifiable lead developer or mastermind that could be taken down, Bitcoin managed to grow quietly and organically. The fact that even the founder is unknown and does not hold a central position of power underscores the very integrity and value proposition of Bitcoin.

Having been brought to life in this very unique fashion and in the midst of the 2008 financial crisis chaos, the idea and implementation of Bitcoin could not have been chosen more timely. Bitcoin has been growing ever since, mimicking the phenomenon of emergent or spontaneous order. Because of its original inception, it seems unlikely that anything similar to Bitcoin could ever be repeated.

The disappearance of Satoshi Nakamoto

One of the most mysterious events from the history of Bitcoin must be mentioned: the disappearance of Satoshi Nakamoto. Satoshi has been working on the Bitcoin source code and partaking in discussions on the bitcointalk.org forum until mid-2010. But at that time, Nakamoto stopped all his activities and relegated the control of all the Bitcoin-related domains that he registered and owned.

Nobody has heard from Satoshi ever since, and the estimated 1,000,000 BTC that he owns remain untouched to this day. This massive amount of Bitcoin, known commonly as Satoshi's coins, was worth close to $70 billion at Bitcoin's all-time high of November 2021. This wealth would make Satoshi Nakamoto one of the top 50 richest persons in the world. Although many people have tried to find out his real identity and the reasons for his disappearance, nobody has been able to conclusively prove who really was Satoshi Nakamoto.

Monumental technologies

In addition to Bitcoin's right timing, original inception and immaculate conception, its monumental technological accomplishment consists in solving the ancient Byzantine General's Problem. The problem, which remained unsolved until the emergence of Bitcoin, was the following: How can a group of non-trusting, physically separated participants arrive at consensus on a mutual task?

For centuries, there was no solution to the Byzantine Generals' Problem. By providing a coherent and elegant solution, Bitcoin's public blockchain made it possible for a distributed group of mutually non-trusting individuals to come to a permanent agreement on a set of evolving transactions, without the need for a centralized party. Because Bitcoin is about value transfer, the solution to the Byzantine General's Problem is ultimately a solution to the double-spend problem.

The double-spending problem

Fundamental for any form of decentralized digital money to be viable, the double-spending problem is the challenge of preventing a given unit of money to be spent more than once by the same person.

Bitcoin really is a game-changer, the same way the printing press was. Conceived by Johann von Gutenberg, the printing press standardized and democratized the process of packaging and transmitting information, enabling the exchange and dissemination of information peer-to-peer across great distances with no intermediaries involved. What Satoshi designed was fundamentally the same thing but for the exchange of value.

Yet again, Bitcoin wouldn't be Bitcoin if there wasn't more to the story. While trustless value transfer was a crucial component, digital scarcity was another. In the case of Bitcoin, digital scarcity was written in stone within the code: there will only ever be 21 million bitcoins that can be created.

A new model for economic prosperity

By solving the double-spending problem, making peer-to-peer value transfer without intermediaries possible, and introducing absolute digital scarcity, Bitcoin has ushered in the era of a truly digital form of money. As such, Bitcoin equals the discovery of gold in the realm of Internet.

If we take the history of physical gold as a comparison, we can see that it bolstered economic prosperity for centuries. As a matter of fact, humanity only started to scale up once commodity money in the form of precious metals was found, helping people to coordinate with strangers and adopt a division of labor and knowledge outside their tribal communities.

Afterwards, paper currencies appeared on top of gold and helped scale value interactions beyond limiting factors such as portability, but eventually led to the decoupling of money and currencies. Ultimately, ties between gold and paper were cut off completely in the 70s.

With the advent of the computer age in the 80s, the physicality of paper currencies was supplanted by the rise of electronic currencies. Today, what we call money is in most cases electronic book entries in the centralized ledger of a bank. Any link to the commodity money that is gold has long been severed.

Bitcoin, on the other hand, introduces the age of digital gold with unrivaled social scalability possibilities, without making any trade-off between the concepts of money and currency. This is truly revolutionary.

Modernity's missing link

Surprising to many but hopefully obvious to readers of this article, Bitcoin's revolution can turn out to be even bigger than the printing press. While the printing press freed information from its physicality to make it easily transferable, Bitcoin lets value travel over any distance instantly while retaining digital scarcity. This is what makes natively digital money possibly.

Bitcoin is digital gold that is scalable and programmable, making it optimally transferable across space and time. In space because of its informational and digital nature, over time because of its absolute digital scarcity.

Bitcoin is the missing link that the modern connected world has been lacking. What we are currently witnessing with Bitcoin is a form of creative destruction taking place on the level of money itself. It's then only logical to expect the world's gigantic banking and finance industry, which exists thanks to very concept of money, to transform significantly over the following decades.

It's been a great success so far: Bitcoin was worth a couple cents at its inception, $1 after less than a year, from $100 to $1,000 dollars in 2013, to an all-time high of $73,738 in 2024:

With the emergence of a new cybermoney economy, more and more people and financial institutions are onboarding onto this new foundation which is digital gold. With its technological superiority and enormous growth potential, it is likely that the cybermoney economy spanning Bitcoin is going to be among the largest economies in the world.

9 minutes|Pascal Hügli|Published 2020-10-08|Updated 2024-06-13